Discrete Choice and Random Utility Models

PyCon Ireland

Data Science @ Personio

and Open Source Contributor @ PyMC

11/11/23

Preliminaries

I am not an Economist

- I’m a data scientist at Personio

- Bayesian statistician,

- Reformed philosopher and logician.

- Website: https://nathanielf.github.io/

Disclaimer

None of Personio’s data was used in this presentation

Code or it didn’t Happen

The worked examples used here can be found here

The Pitch

Predictive Models are inadequate decision making tools in product demand analysis.

Accept no substitutes for bayesian discrete choice models and causal inference.

Agenda

- History and Background

- Modelling Choice Scenarios

- Market Structure and Substitution Patterns

- Model Adequacy and Counterfactuals

- Individual Heterogenous Utility

- Conclusion

- The World in the Model

History and Background

A brief survey of historical use-cases and the kinds of problems Bayesian discrete choice models can solve.

McFadden and BART

“Transport projects involve sinking money in expensive capital investments, which have a long life and wide repercussions. There is no escape from the attempt both to estimate the demand for their services over twenty or thirty years and to assess their repercussions on the economy as a whole.” - Denys Munby, Transport, 1968 ”

Revealed Preference and Predicting Demand

Self Centred Utility Maximisers?

- The assumption of revealed preference theory is that if a person chooses A over B then their latent subjective utility for A is greater than for B.

- Survey data estimated about 15% of users would adopt the newly introduced BART system. McFadden’s random utility model estimated 6%.

- He was right.

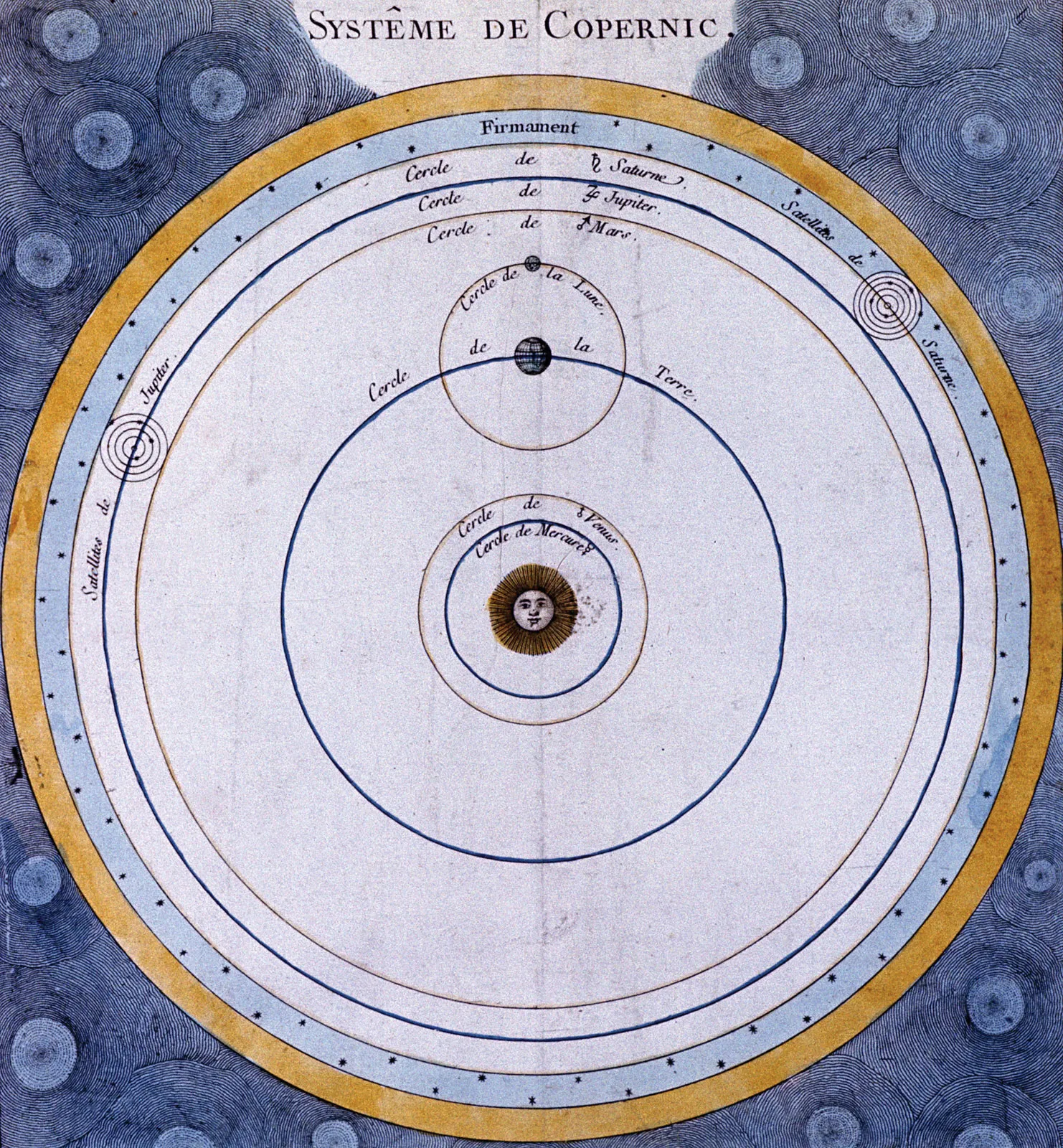

- Copernican Shift: He estimated utility to predict choice, rather than infer utility from stated choice.

General Applicability of Choice Problems

- These models offer the possibility of predicting choice in diverse domains: policy, brand, school, car and partners.

- Hard Question: What are the attributes that drive these choices? How well are they measurable?

- Harder Question: How do changes in these attributes influence the predicted market demand for these choices?

Note on Model Evaluation

Replicating the Super Soldier Program

Note on Model Evaluation

Replicating the Super Soldier Program

Modelling Choice Scenarios

We elaborate the basic multinomial model for choice and a problem with it.

Choice: The Data

Gas Central Heating and Electrical Central Heating described by their cost of installation and operation.

| choice_id | chosen | ic_gc | oc_gc | … | oc_ec |

|---|---|---|---|---|---|

| 1 | gc | 866 | 200 | … | 542 |

| 2 | ec | 802 | 195 | … | 510 |

| 3 | er | 759 | 203 | … | 495 |

| 4 | gr | 789 | 220 | … | 502 |

The Multnomial Model:

Product Specific Intercepts

\[ \begin{split} \begin{pmatrix} \color{red}{u_{gc}} \\ \color{purple}{u_{gr}} \\ \color{orange}{u_{ec}} \\ \color{teal}{u_{er}} \\ 0 \end{pmatrix} = \begin{pmatrix} \color{red}{\alpha_{gc}} + \color{blue}{\beta_{ic}}gc_{ic} + \color{blue}{\beta_{oc}}gc_{oc} \\ \color{purple}{\alpha_{gr}} + \color{blue}{\beta_{ic}}gr_{ic} + \color{blue}{\beta_{oc}}gr_{oc} \\ \color{orange}{\alpha_{ec}} + \color{blue}{\beta_{ic}}ec_{ic} + \color{blue}{\beta_{oc}}ec_{oc} \\ \color{teal}{\alpha_{er}} + \color{blue}{\beta_{ic}}er_{ic} + \color{blue}{\beta_{oc}}er_{oc} \\ 0 + 0 + 0 \end{pmatrix} \end{split} \]

The Multnomial Model:

Utility determines choice probability of choice:

\[\text{softmax}(\color{green}{u})_{j} = \frac{\exp(\color{green}{u_{j}})}{\sum_{q=1}^{J}\exp(\color{green}{u_{q}})}\]

choices determine market share where:

\[ s_{j}(\mathbf{\color{blue}{\beta}}) = P(\color{green}{u_{j}} > \color{green}{u_{k}}; ∀k ̸= j) \]

The Maximum Likelihood Estimation Strategy

The model is traditionally estimated with maximum likelihood caclulations.

\[ L(\color{blue}{\beta}) = \prod s_{j}(\mathbf{\color{blue}{\beta}}) \]

or taking the log:

\[ l(\color{blue}{\beta}) = \sum log(s_{j}(\mathbf{\color{blue}{\beta}})) \] \[ \text{ We find: } \underset{\color{blue}{\beta}}{\mathrm{argmax}} \text{ } l(\color{blue}{\beta}) \]

Results are often brittle!

Bayesian Estimation

To evaluate the integrals in the Bayesian model we use MCMC to estimate conditional probabilities of the joint distribution.

\[\underbrace{\color{blue}{\beta}}_{\text{prior draws}} \sim Normal(0, 1) \]

\[ \underbrace{p(\color{blue}{\beta} | D)}_{\text{posterior draws}} = \frac{p(\mathbb{\color{blue}{\beta}})p(D | \color{blue}{\beta} )}{\int_{i}^{n} p(D | \mathbf{\color{blue}{\beta_{i}}})p(\mathbf{\color{blue}{\beta_{i}}}) } \]

Priors can be used flexibly to regularise and improve reliability of estimation across structural causal models.

The Model:

Utilities in Code

with pm.Model(coords=coords) as model_2:

## Priors for the Beta Coefficients

beta_ic = pm.Normal("beta_ic", 0, 1)

beta_oc = pm.Normal("beta_oc", 0, 1)

alphas = pm.Normal("alpha", 0, 1, dims="alts_intercepts")

## Construct Utility matrix and Pivot using an intercept per alternative

u0 = alphas[0] + beta_ic * wide_heating_df["ic.ec"] + beta_oc * wide_heating_df["oc.ec"]

u1 = alphas[1] + beta_ic * wide_heating_df["ic.er"] + beta_oc * wide_heating_df["oc.er"]

u2 = alphas[2] + beta_ic * wide_heating_df["ic.gc"] + beta_oc * wide_heating_df["oc.gc"]

u3 = alphas[3] + beta_ic * wide_heating_df["ic.gr"] + beta_oc * wide_heating_df["oc.gr"]

u4 = np.zeros(N) # Outside Good

s = pm.math.stack([u0, u1, u2, u3, u4]).T

## Apply Softmax Transform

p_ = pm.Deterministic("p", pm.math.softmax(s, axis=1), dims=("obs", "alts_probs"))

## Likelihood

choice_obs = pm.Categorical("y_cat", p=p_, observed=observed, dims="obs")The Problem: Interpreting the Model

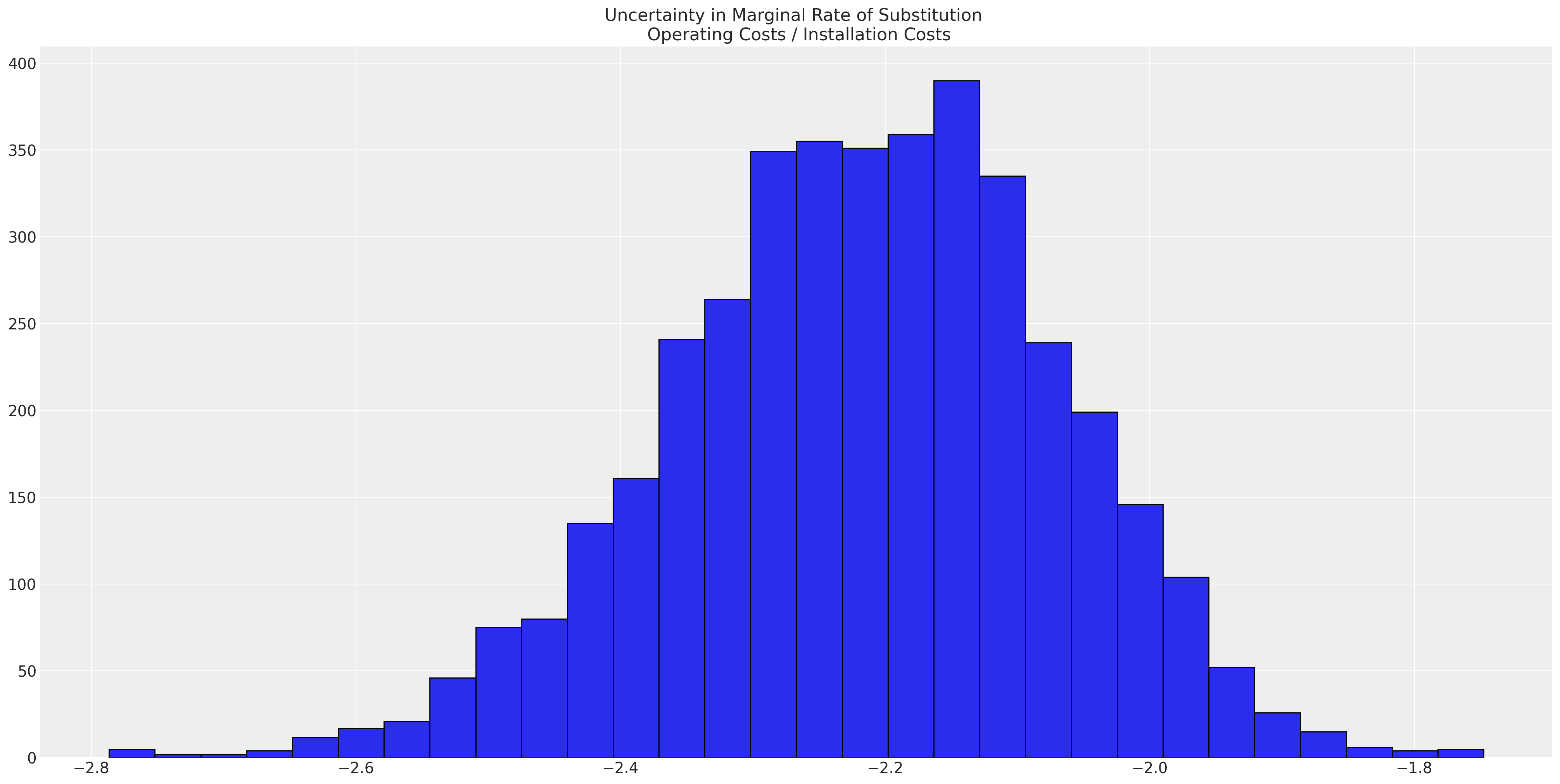

Rate of Substitution

The beta coefficients in the model are interpreted as weights of utility. However, the precision in these latent terms is relative to the variance of unobserved factors.

The utility scale is not fixed, but the ratio \(\frac{\beta_{ic}}{\beta_{oc}}\) is invariant.

The Problem: Model Structure:

The Process of Bayesian Updating calibrates the parameter estimates against the data

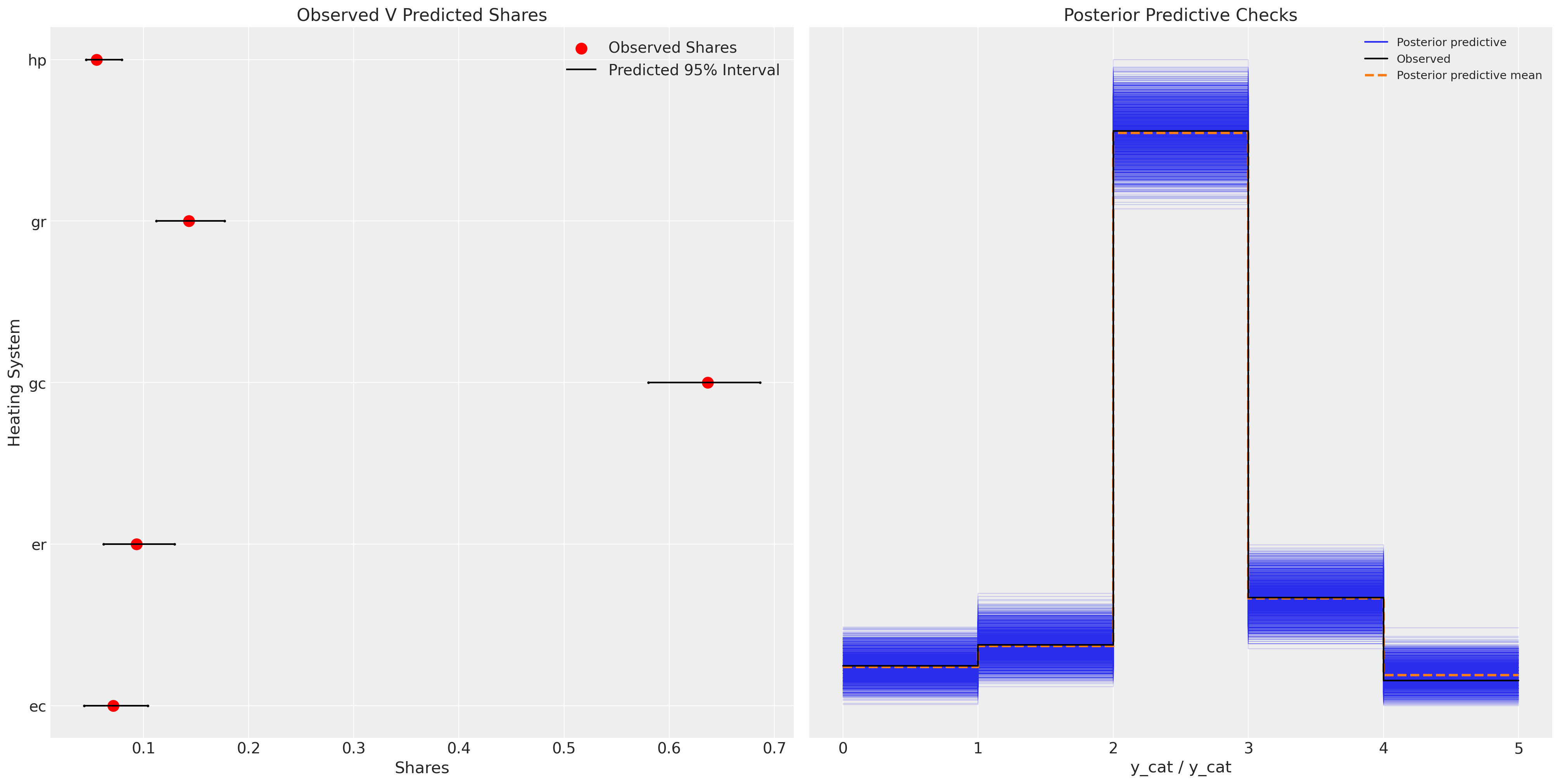

The Problem: Model Fit

Posterior Predictive Distribution

The model successfully predicts observed market share

The Problem: IIA

New Products Cannibalise Equally from all Alternatives

- Suppose a market choice between transport modes is determined by the above model.

- Red Bus or Car are you initial Options. Assume \(s_{\color{red}{bus}}(\beta) = s_{car}(\beta)\). Market Share is 50% to each option.

- Introduce the Blue Bus Option, then the Independent characteristics of the utility specification implies that \(s_{\color{red}{bus}}(\beta) = s_{car}(\beta) = s_{\color{blue}{bus}}(\beta)\)

- This implies an implausible substitution pattern for real markets.1

Market Structure and Substitution Patterns

Model tries to account for pathological patterns of sustitution between goods by incorporating covariance structures.

Adding Correlation Structure

Dependence in Market Share

\[ \alpha_{i} \sim Normal(\mathbf{0}, \color{brown}{\Gamma}) \]

\[ \begin{split} \begin{pmatrix} \color{red}{u_{gc}} \\ \color{purple}{u_{gr}} \\ \color{orange}{u_{ec}} \\ \color{teal}{u_{er}} \\ 0 \end{pmatrix} = \begin{pmatrix} \color{red}{\alpha_{gc}} + \color{blue}{\beta_{ic}}gc_{ic} + \color{blue}{\beta_{oc}}gc_{oc} \\ \color{purple}{\alpha_{gr}} + \color{blue}{\beta_{ic}}gr_{ic} + \color{blue}{\beta_{oc}}gr_{oc} \\ \color{orange}{\alpha_{ec}} + \color{blue}{\beta_{ic}}ec_{ic} + \color{blue}{\beta_{oc}}ec_{oc} \\ \color{teal}{\alpha_{er}} + \color{blue}{\beta_{ic}}er_{ic} + \color{blue}{\beta_{oc}}er_{oc} \\ 0 + 0 + 0 \end{pmatrix} \end{split} \]

Adding Correlation Structure

Priors on Parameters determine Market Structure

\[ \begin{split} \color{brown}{\Gamma} = \begin{pmatrix} \color{red}{1} , \gamma , \gamma , \gamma \\ \gamma , \color{blue}{1} , \gamma , \gamma \\ \gamma , \gamma , \color{orange}{1} , \gamma \\ \gamma , \gamma , \gamma , \color{teal}{1} \end{pmatrix} \end{split} \]

Adding Correlation Structure

Covariance in Code

with pm.Model(coords=coords) as model_3:

beta_ic = pm.Normal("beta_ic", 0, 1)

beta_oc = pm.Normal("beta_oc", 0, 1)

beta_income = pm.Normal("beta_income", 0, 1 dims="alts_intercepts")

chol, corr, stds = pm.LKJCholeskyCov(

"chol", n=4, eta=2.0,

sd_dist=pm.Exponential.dist(1.0, shape=4)

)

alphas = pm.MvNormal("alpha", mu=0, chol=chol, dims="alts_intercepts")

u0 = (

alphas[0]

+ beta_ic * wide_heating_df["ic.gc"]

+ beta_oc * wide_heating_df["oc.gc"]

+ beta_income[0] * wide_heating_df["income"]

)

u1 = (

alphas[1]

+ beta_ic * wide_heating_df["ic.gc"]

+ beta_oc * wide_heating_df["oc.gc"]

+ beta_income[1] * wide_heating_df["income"]

)

u2 = (

alphas[2]

+ beta_ic * wide_heating_df["ic.gc"]

+ beta_oc * wide_heating_df["oc.gc"]

+ beta_income[2] * wide_heating_df["income"]

)

u3 = (

alphas[3]

+ beta_ic * wide_heating_df["ic.gr"]

+ beta_oc * wide_heating_df["oc.gr"]

+ beta_income[3] * wide_heating_df["income"]

)

u4 = np.zeros(N) # pivot

s = pm.math.stack([u0, u1, u2, u3, u4]).T

p_ = pm.Deterministic("p", pm.math.softmax(s, axis=1), dims=("obs", "alts_probs"))

choice_obs = pm.Categorical("y_cat", p=p_, observed=observed, dims="obs")Adding Correlation Structure

Structural Dependence

Correlation Structure

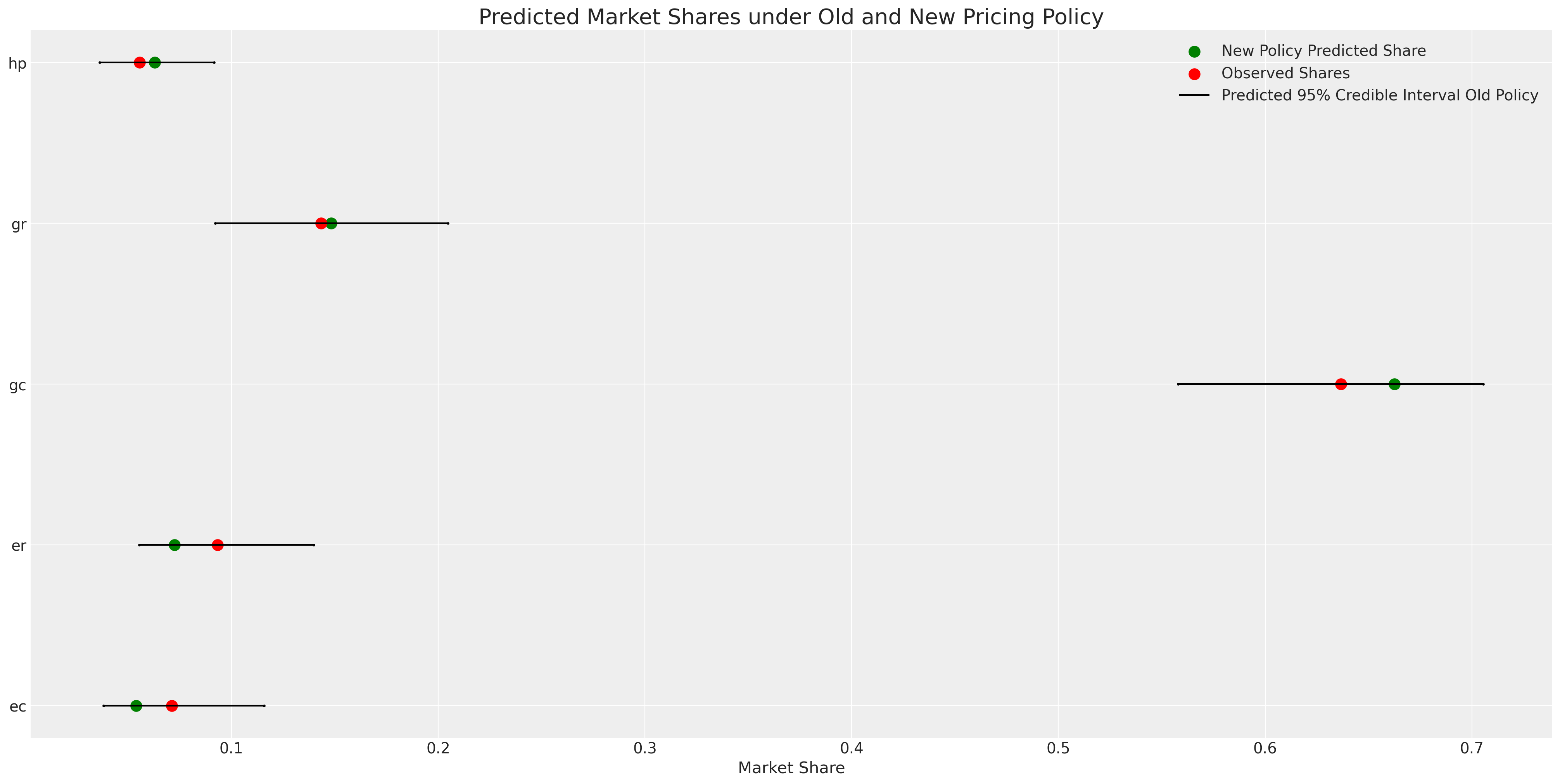

Model Adequacy and Counterfactuals

Models as laboratories for experimentation

Model Adequacy and Counterfactuals

Ceteris Paribus Laws

With a fitted PyMC model we can counterfactually reset the values for the input data and regenerate the posterior predictive distribution holding else equal in the data generating process.

- What would the market share be like if prices for electrical systems increased 20%?

# update values of predictors with new 20%

# price increase in operating costs for electrical options

with model_3:

pm.set_data({"oc_ec": wide_heating_df["oc.ec"] * 1.2,

"oc_er": wide_heating_df["oc.er"] * 1.2})

# use the updated values and predict outcomes and probabilities:

idata_new_policy = pm.sample_posterior_predictive(

idata_m3,

var_names=["p", "y_cat"],

return_inferencedata=True,

predictions=True,

extend_inferencedata=False,

random_seed=100,

)

idata_new_policyModel Adequacy and Counterfactuals

Pricing Experiments

Counterfactual Shares

Model Adequacy and Counterfactuals

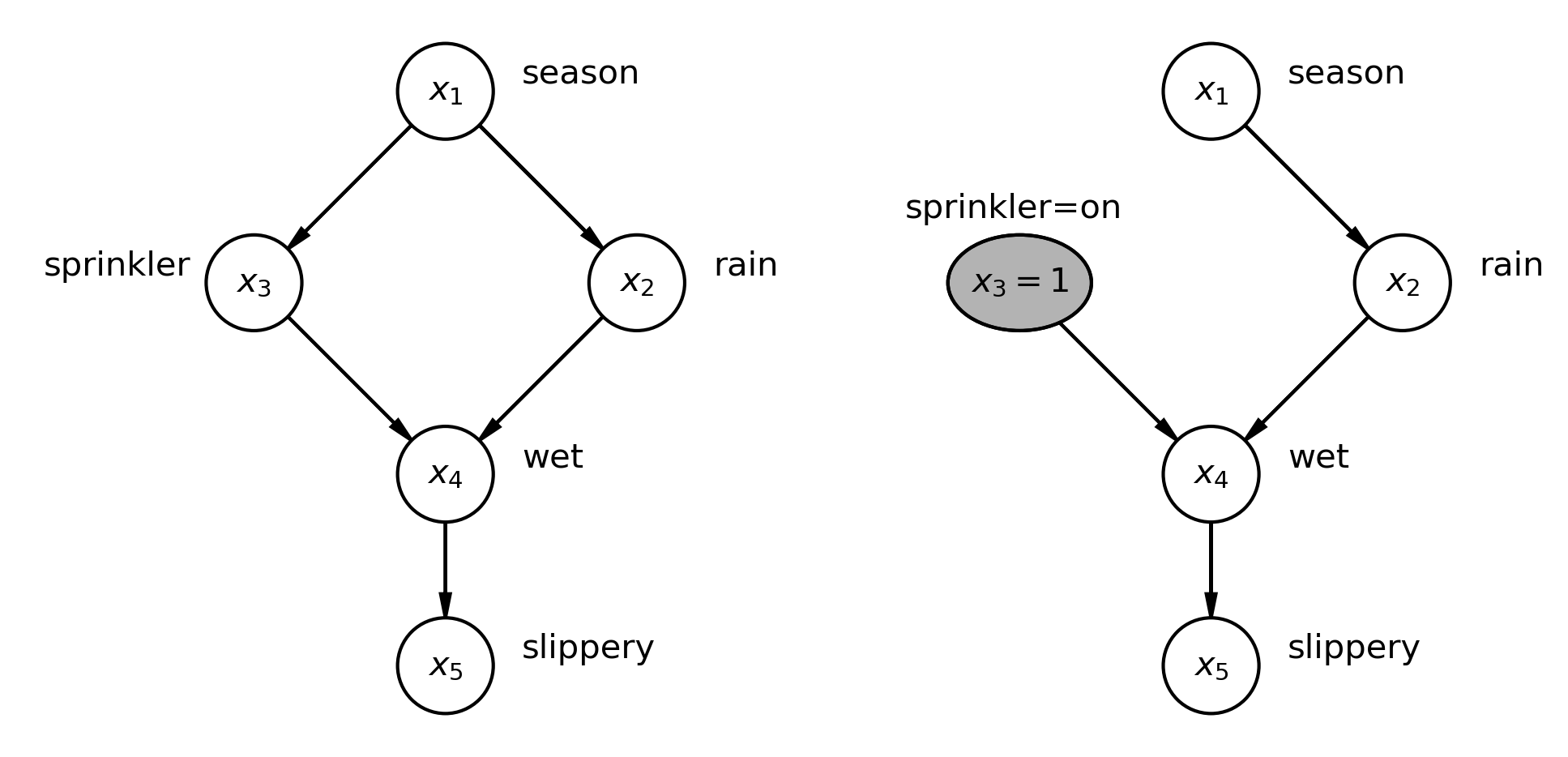

Interventions and Conditionalisation

- There is a sharp distinction between conditional probability distributions and probability under intervention

- In PyMC you can implement the do-operator to intervene on the graph that represents your data generating process.

Hierarchical Variations

Inducing covariance structures by allowing individual deviations from mean utilities.

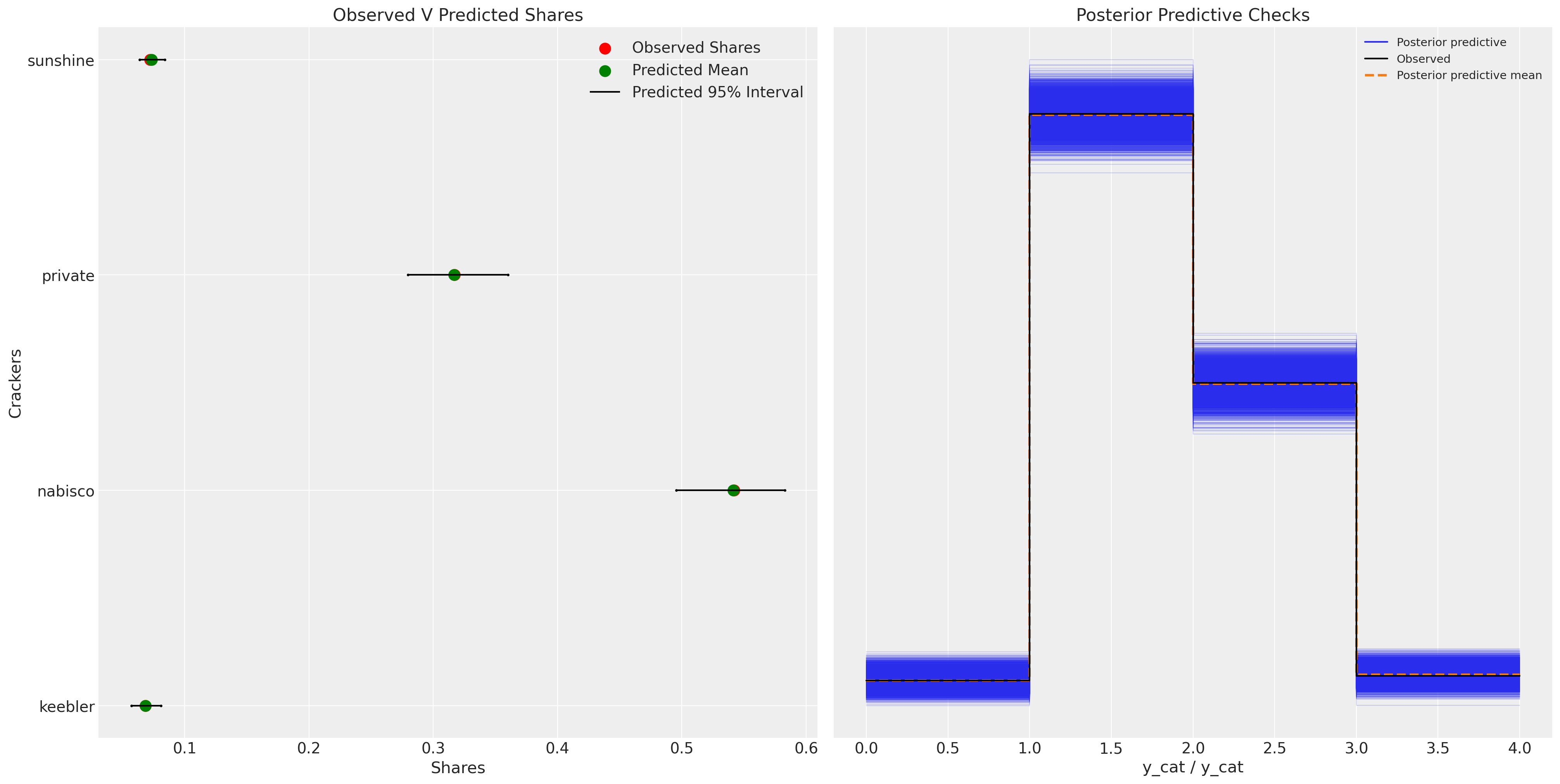

Individual Heterogenous Utility

Repeated Choice and Hierarchical Structure

| person_id | choice_id | chosen | nabisco_price | keebler_price |

|---|---|---|---|---|

| 1 | 1 | nabisco | 3.40 | 2.00 |

| 1 | 2 | nabisco | 3.45 | 2.50 |

| 1 | 3 | keebler | 3.60 | 2.70 |

| 2 | 1 | keebler | 3.48 | 2.20 |

| 2 | 2 | keebler | 3.30 | 2.25 |

Individual Heterogenous Utility

\[ \begin{split} \begin{pmatrix} \color{red}{u_{i, nb}} \\ \color{purple}{u_{i, kb}} \\ \color{orange}{u_{i, sun}} \\ 0 \end{pmatrix} = \begin{pmatrix} (\color{red}{\alpha_{nb}} + \beta_{i}) + \color{blue}{\beta_{p}}p_{nb} + \color{green}{\beta_{disp}}d_{nb} \\ (\color{purple}{\alpha_{kb}} + \beta_{i}) + \color{blue}{\beta_{p}}p_{kb} + \color{green}{\beta_{disp}}d_{kb} \\ (\color{orange}{\alpha_{sun}} + \beta_{i}) + \color{blue}{\beta_{p}}p_{sun} + \color{green}{\beta_{disp}}d_{sun} \\ 0 + 0 + 0 \end{pmatrix} \end{split} \]

Individual Heterogenous Utility

In Code

with pm.Model(coords=coords) as model_4:

beta_feat = pm.TruncatedNormal("beta_feat", 0, 1, upper=10, lower=0)

beta_disp = pm.TruncatedNormal("beta_disp", 0, 1, upper=10, lower=0)

## Stronger Prior on Price to ensure

## an increase in price negatively impacts utility

beta_price = pm.TruncatedNormal("beta_price", 0, 1, upper=0, lower=-10)

alphas = pm.Normal("alpha", 0, 1, dims="alts_intercepts")

beta_individual = pm.Normal("beta_individual", 0, 0.05,

dims=("individuals", "alts_intercepts"))

u0 = (

(alphas[0] + beta_individual[person_indx, 0])

+ beta_disp * c_df["disp.sunshine"]

+ beta_feat * c_df["feat.sunshine"]

+ beta_price * c_df["price.sunshine"]

)

u1 = (

(alphas[1] + beta_individual[person_indx, 1])

+ beta_disp * c_df["disp.keebler"]

+ beta_feat * c_df["feat.keebler"]

+ beta_price * c_df["price.keebler"]

)

u2 = (

(alphas[2] + beta_individual[person_indx, 2])

+ beta_disp * c_df["disp.nabisco"]

+ beta_feat * c_df["feat.nabisco"]

+ beta_price * c_df["price.nabisco"]

)

u3 = np.zeros(N) # Outside Good

s = pm.math.stack([u0, u1, u2, u3]).T

# Reconstruct the total data

## Apply Softmax Transform

p_ = pm.Deterministic("p", pm.math.softmax(s, axis=1), dims=("obs", "alts_probs"))

## Likelihood

choice_obs = pm.Categorical("y_cat", p=p_, observed=observed, dims="obs")

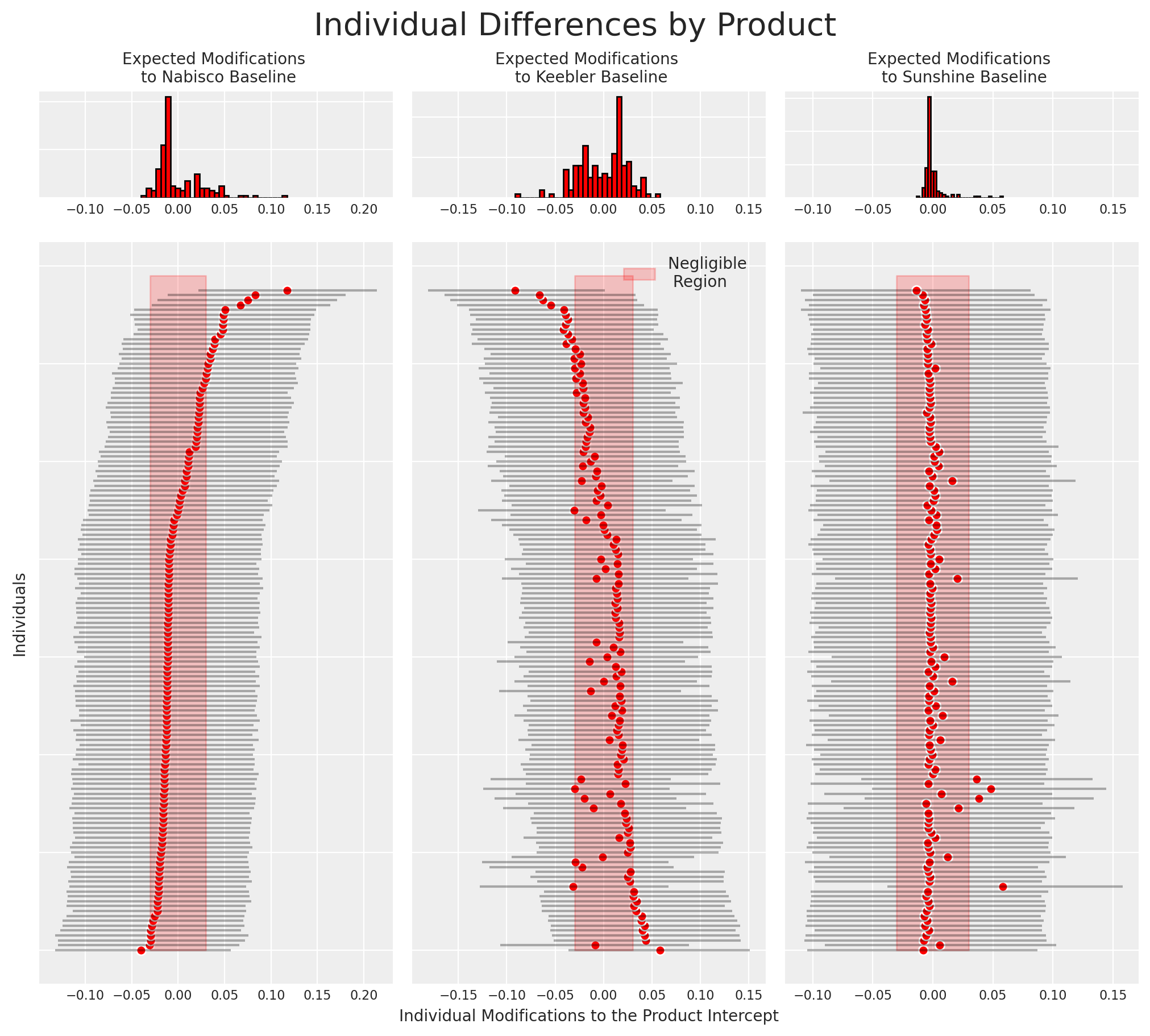

Individual Heterogenous Utility

Recovered Posterior Predictive Distribution

Individual Heterogenous Utility

Individual Preference

- Individual preferences can be derived from the model in this manner.

- The relationship between preferences over the product offering can be seen too

- Market stable under stable preferences?

Conclusion

The World in the Model

“Models… [are] like sonnets for the poet, [a] means to express accounts of life in exact, short form using languages that may easily abstract or analogise, and involve imaginative choices and even a certain degree of playfulness in expression” - Mary Morgan in The World in the Model

- Models should articulate the relevant structure of this world and other possible ones.

- They serve as microscopes. Simulation systems are tools to interrogate reality.

- Bayesian Conditionalisation calibrates the system against the observed facts.

- Bayesian Discrete choice models help us interrogate aspects of market demand under uncertainty.

- PyMC enables us to easily build and experiment with those models.

- Causal inference is plausible to degree that we can defend the structural assumptions. Bayesian models enforce tranparency and justification of structural commitments and necessary complexity.

Discrete Choice with PyMC